We recommended TV18 at Rs. 37 with a BUY report named TV18: Colorful Infotainment. Currently, TV18 is trading at Rs. 44, indicating 19% returns so far. Recently, TV18 announced its Q2FY17 results. Here are certain updates regarding the same.

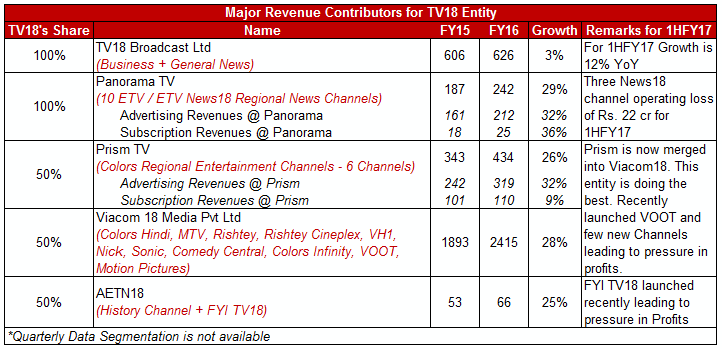

1. Good Growth across Basket Achieved: In FY16, TV18 achieved a phenomenal topline growth of 29% in regional news and approximately 27% in entertainment channels. The effects of this are not seen in the bottom line improvement mainly because of spending on new initiates (as explained ahead).

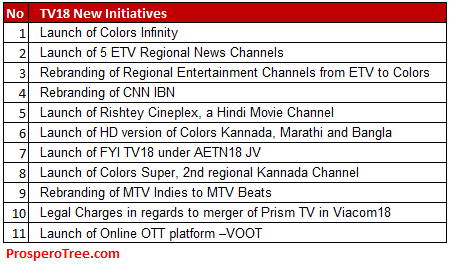

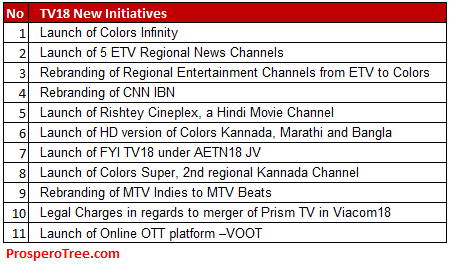

2. Write downs in FY15 and One-offs in new initiatives in FY16: The lower profits of TV18 for last 3 years can be attributed to the write downs and one-off expenses incurred due to new initiatives in the company. It is important to understand that write downs were related to cleaning of balance sheet whereas one-offs are due to new business initiative taken by TV18.

a. Write-downs: After taking over the control of TV18 from Raghav Bahl, the new management cleaned the balance sheet in FY15. This was done by providing writing off Rs. 233 crores in the form of asset impairments, inventory write-downs, and writing off doubtful debts.

b. Business Oneoffs: Over the last 6-8 quarters, TV18 has launched a series of additional news channels and entertainment channels leading to large upfront costs each quarter. In addition to this, TV18’s subsidiary Viacom18 also launched an online OTT platform which requires significant spending for technology and marketing in the initial period. All these costs are termed as one-offs from new initiatives by TV18. This is especially true as new initiatives can take 6-24 months to break even at the operating level. Over the last 18 months from Q1FY16 to Q2FY17, the company has spent Rs. 217 crores for new initiatives as below:

3. Understanding TV18's P&&L Statement:

a. Change in Accounting Rules Makes Consolidated Revenues Look Much Lower: Until FY16, the revenues of its two JVs (Prism TV JV and Viacom18 JV) were consolidated proportionately to its consolidated revenues. However, due to accounting standards changes, the JV revenues are no more consolidated leading to sharp fall in consolidated revenues. This fall is not a real fall in revenues but just a change in accounting treatment.

b. Prism JV -Journey from 'Subsidiary’ to 'Joint Venture' to 'Merger with Viacom JV': Until July2016, Prism TV was a 50% owned 'subsidiary' of TV18. This led to addition of 100% revenues in consolidated results until Jul2015 (4 months of FY16). Post 1Aug2015, Viacom International acquired other 50% stake of Prism TV thereby making Prism TV a 50% Joint Venture Company from a 50% subsidiary. Due to changes from subsidiary to JV, accounting method changed from 100% revenues consolidation to 50% revenue consolidation for Aug15-Mar16 (8 months of FY16).

Since Apr2016 (FY17), the new accounting standards disallowed the revenues of Joint ventures to be considered for consolidation. Naturally this decreased the consolidated revenues of TV18 optically from Q1FY17. However, this does not have any real impact on absolute profitability as the profits from Joint Venture would have to be put as a single line item on a proportionate basis as a part of "Share from Joint Ventures".

In Q2FY17, TV18 finally took a welcome step to simplify the operating structure by merging Prism TV into Viacom18 and thereby operating all its entertainment (Hindi, English, Kids, Regional) channels into one single entity of Viacom18.

4. Conclusion: Strategically, TV18 has taken all the right steps in creating a stronger foundation by expanding its channel basket in entertainment as well as news channels. It is only a matter of time (12-24 months) wherein its efforts should start paying in the form of better profitability as the company should start seeing most of its channels entering into a mature phase.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.