Name TV18 Broadcast Ltd.

Type of Report Fresh Recommendation

Report Date 7-Dec-2015

Price on Report Date Rs. 37

Current Market Cap Rs. 6351 cr

View Buy

Indicative Target Price* Rs. 60 - 70

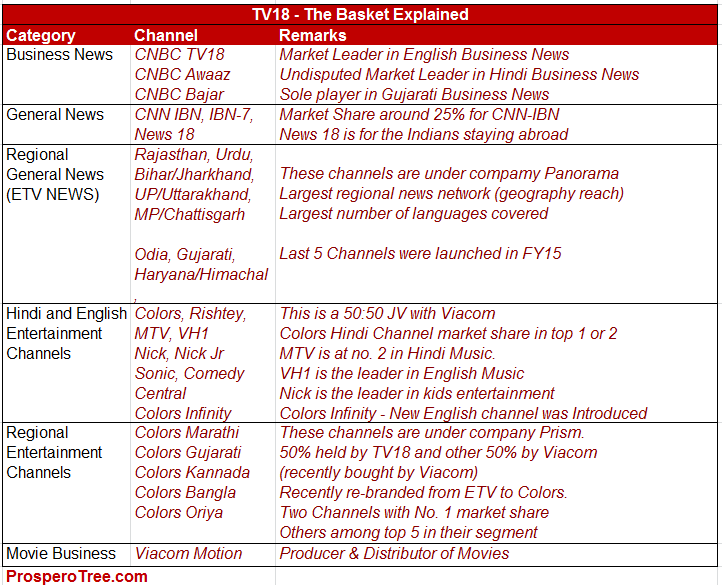

Company Background: TV18 Broadcast Ltd (TV18) operates various News and Entertainment channels on its own, through its subsidiaries and Joint Ventures. It is India’s one of the largest television broadcast networks, having 34 channels catering to specific regional and national audiences.

History: Near the end of FY12, Mukesh Ambani led Reliance Group bought the debt beleaguered media group of Raghav Bahl. As a part of the deal, Reliance Group infused capital in TV18 (via Network 18). These funds were subsequently used to Purchase stake in ETV channels, invest funds in Viacom18 and repay a large portion of the debt.

Investment Arguments:

1. Big Bouquet of Channels catering across masses: TV18 operates 34 news and entertainment channels in Hindi, English and other regional languages across India. It is now considered as one of the largest TV networks in India after Star and Zee. With its strong content, increasing channel basket and rising leadership will further lead to stronger business in the future.

2. Sector tailwinds very strong: Today, the TV broadcasters generate revenues mainly from advertisements and subscriptions, both of which are showing very strong tailwinds. With growing consumerism, economic revival and arrival of e-commerce, the demand for TV advertisement is growing at 12-15%. At the same time, the government's focus on digitization of cable networks should lead to much stronger growth of subscription revenues at 15-16% per year.

3. Write-offs are History: Until 2014, the control of TV18 was not taken over by Reliance Group from Raghav Bahl. However, in FY14, Reliance Group exercised its control and the company saw many high profile exits.

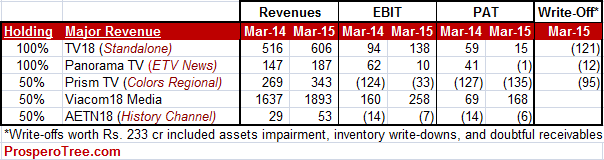

The incoming management cleaned TV18 balance sheet as above and wrote-off a large amount worth Rs. 233 crores in FY15. This write-off included assets impairment, inventory write-off and provision for doubtful debts. This write-off severely affected the profitability of the company. However, if the numbers are seen in the context of operational performance, TV18 saw a sustaining improvement in numbers over the last two years.

We think that write-offs are now history and TV18 Broadcast should not see any non-operational one-time expenses or losses.

4. Strong Growth opportunities ahead: In FY15, the company saw strong growth across all its businesses.

- Standalone business (Business News): The standalone business that caters to business news and general news saw its revenue growing by 17% in FY15 due to the general assembly election. Subsequently in 1HFY16 the revenue de-grew on YoY basis due to higher base of 1HFY15 set by general assembly election. However, the company has re-strategized, focused on improvement in its content, and increased the management breadth through recent hiring at group level (Eg: Mr Rahul Joshi of Times Group). We think that with CNBC brand and renewal of tie-up with CNN, the business news and general news basket stand a strong chance of further increasing market share in coming 2-3 years.

- Panorama TV (ETV News): In FY15, ETV news basket grew at a healthy rate of 27% to Rs. 187 cr in revenues. In late FY15, ETV News increased its channel basket from 5 channels to 10 channels covering 14 states –all in regional news category. With such a big basket of regional news channels, the benefits of the same will be seen in coming years. In addition, India being a vast country, it witnesses continuous elections (assembly, state, etc) across states which will periodically increase revenues for its regional channels.

- Prism TV (now Colors regional): The regional entertainment channels (previously known as ETV Entertainment Channels) saw its revenue increasing by 27% in FY15 thereby reducing its operational losses from Rs. 124 cr to Rs. 33 cr. To further increase viewership, it was decided by the management to utilize the Colors Brand to the regional portfolio. Due to which, in 1HFY16, the 5 ETV regional channels have been rebranded as Colors Regional Channels at a cost of Rs. 10 crores in 1HFY16.

- Viacom18 Media(Entertainment Channels): Viacom18 JV grew by 16% in FY15 and registered an outstanding growth of 60% at operating level. As the channels basket has matured, Viacom18 now stands at a juncture where it will reap benefits in form of good advertisement revenue growth as well as stupendous subscription growth. Not only this, the company is further investing and slowly increasing channel basket. In 1HF16, Viacom18 has launched a English entertainment channel under the colors brand named Colors Infinity, due to which Viacom18 has incurred an extra marketing cost of Rs. 19 crores in 1HFY16.

- Viacom18 Motion Pictures (Movie Business): Viacom18 motions pictures is involved in acquisition, production and marketing of Indian films. Over last 5 years, Viacom18 has produced and distributed more than 60 films, many of which have been super-hit films. In last 2 years, movies like Pyaar Ka Panchnama 2, Manjhi, Drishyam, Queen, Gabbar is Back and Mary Kom among others made a huge success on the box office.

Based on our evaluation, we think FY16 operating profits will form the bottom profits and will lead the future growth.

5. Valuation concerns for Prism TV/ Panorama TV resolved: TV18 paid Rs. 1925 cr for the acquisition of below:

- 100% stake in Panorama TV (regional news)

- 50% stake in Prism TV (regional entertainment)

- 24.5% stake in Enadu TV

Many investors cried foul over its valuation mainly because the other 50% stake was held directly by Reliance Group. However, recently in 2015, Viacom Inc purchased 50% stake in Prism TV from Reliance Group for Rs. 950 crores. This too a great extent validates the acquisitions done in the past and should clear the clout in the mind of shareholders.

6. Launch of Reliance Jio may increase viewership for TV18: Reliance Jio is expected to lauch its 4G services shortly. Being a group company, Reliance Jio users may get free access of entire content of TV18 basket. This may not be directly remunerative in the form of revenues but will surely translate in to higher viewership and therefore high advertisement revenues.

7. Balance Sheet cleaned; clarity to emerge: It is a nightmare to dig TV18s balance sheet due to the acquisition, equity expansion, onetime write-offs, debt repayment and multiple subsidiaries / JV structure. However, post FY15 the balance sheet has drastically improved with major write-downs done, clarity in structure and very minor debt outstanding.

To simplify the holding structure of TV18 Broadcast, here is the thumb rule: Reliance group holds 100% in all news channels and 50% in all entertainment channels.

Valuation:

TV18 was one place where all forms of activity took place in a short span of 2-3 years. TV18 ventured into multiple high-growth businesses, raised debt, acquired new businesses, infused funds and ultimately the management control was changed who emphasized on cleaning the balance sheet. To estimate the future by taking cues from the past is extremely difficult. However, here are some metrics that will give a good sense on why we think TV18 is undervalued and offers good upside to investors:

- Considering the business tailwind the overall profitability is expected to see considerable improvement in profits and cash flows over next 2 years.

- Considering the recent deal of Star acquiring Maa TV, TV18 clearly makes a strong case of worthy investment. Star TV bought 4 regional entertainment channels of Maa TV for Rs. 2400 crores against the total market size of entertainment business of Rs. 2000 crores. (TV18 has 34 channels across India / TV18 MCAP = Rs. 6350 cr)

- Viacom18 JV made a profit of Rs. 168 cr in FY15. It can surely command valuation multiple of leading TV broadcaster of India. In addition to this, Viacom18 Motion Pictures has a very successful track record and can be compared with leading movie production and distributors like UTV Motion Pictures (got delisted at Rs. 3500 cr). Considering its current profits, Viacom18 JV can itself be valued at anywhere between Rs. 6000 to 10000cr.

Key Risks:

- Competition from present TV broadcasters

- New age media and digitization cult can affect the ad revenues

- Breaking of Joint Venture (Viacom) or Brand Tie-ups (CNBC, CNN)

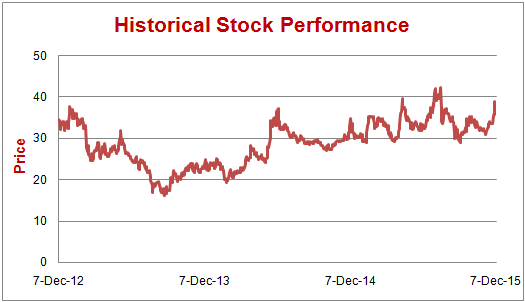

Stock Performance:

*Achievement of Target Price does not imply Sell. We will explicitly release an Exit/Partial Sell Report at an appropriate time.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.