Company Background: MT Educare Ltd (MTEL) is an educational coaching institution providing coaching in 3 different segments – School, Science and Commerce. MTEL network consists of 128 coaching locations across states of Maharashtra (102), Karnataka (16), Punjab (5), Tamil Nadu (2), Gujarat (2) and Haryana (1). In FY15, MTEL has provided coaching to 82,110 students and has 2500+ faculty including visiting faculties.

Innovative and Aggressive Promoters: MTEL started in 1988 with coaching services only to school students in Mumbai. Over the years, the promoters through acquisition and expansion have made MTEL an educational institute for school, graduate and post-graduate students.All the acquisition and expansions have been done mainly through internal accruals which suggest that the promoters are aggressive but prudent. The company has maintained a debt free status and intends to keep the same.

Here are the key investment arguments:

Investment Arguments:

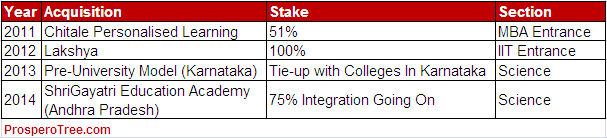

1. MTEL growth history; ability to manage acquisition: In past, MTEL has successfully managed integration of many acquisitions. Some good acquisitions / tie-ups that they have done in the past are:

*Sri Gayatri Education in above table is a tie-up.

2. De-risked Business Model; Multiple Streams, Multiple Geographies: MTEL has a diversified products catering to students right from school to post graduation.

MTEL has presence in 7 states but introduction of Robomate will further help to break all state boundaries and make MTEL a Pan India coaching institute.

3. PU College – A Continuous Growing Business: MT Educare provides coaching services for engineering and medical entrance exams to Pre-University colleges (PU College) in Karnataka. MTEL earns test preparation fees and college management fees from PU colleges. MTEL has already tied-up with 18 colleges in Karnataka in this model. Over next 2-3 years, MTEL plans to nearly double the tie-ups. After achieving success in this model in Karnataka, MTEL has expanded its presence in Andhra Pradesh by forming Sri Gayatri Academy Pvt. Ltd. where it owns 75% stake.

4. Robomate – An Innovative, Boundary Breaker New Generation Product: Robomate is an educational application available on Samsung tablet. This tablet consists of pre-recorded lectures by expert faculties along with multimedia content for concept learning and easy revision. Robomate feature of study anytime from anywhere makes MTEL more competitive and clearly differentiates itself from its competitors. MTEL provides Robomate free of cost to their students. However, they charge fees to non-MT students for the courses they choose on Robomate. In FY15, Robomate did revenue of nearly Rs. 3 crores and is expected to reach double digits this year. Our confidence comes from the fact that the pre-recorded content is now available for all courses / subjects; however this was not the case in FY15. Naturally, revenues from Robomate will have a high impact on bottom-line due to fixed nature of cost.

5. Government skill development –A New Focus Area for MTEL: The new government have emphasized the skill development of the Indian workforce to increase the employability of youth. Government has identified 70 odd skill development programs and MTEL has imparted training to 1550 students in FY15 for some of these skill development programs. Due to its initial success, MTEL is awarded a Letter of Intent from Ministry of Minority Affairs (government undertaking) to impart skill and entrepreneurship training to 30,000 students in FY16 for some of these courses. Once the final contract is awarded, this can lead to total revenue of Rs. 30 crores. Skill development training is a new window of opportunity for MTEL which is easily scalable and we see good growth for MTEL from this segment.

6. Sri Gayatri Academy – Future Growth Driver for MTEL: In order to repeat the success of Karnataka PU College model, MTEL established Andhra Pradesh based Sri Gayatri Academy Pvt. Ltd. where it holds 75% stake. Through this subsidiary, the company has financed Sri Gayatri Academy Education Trust. This financing was done from sales proceed of Mangalore University campus. It took 3 years for MTEL to reach to 18 college tie-ups in Karnataka. However,with the formation of Sri Gayatri Academy Pvt. Ltd, MTEL now has access to 51 colleges & 35000 students of Sri Gayatri Education Trust. The amount lent to Sri Gayatri Education Trust is at the rate of 13% per annum.

7. Higher Profit Generating Asset Light Model: MTEL follows an asset light model by leasing / renting the coaching class premises. In order to maintain asset light model, MTEL recently sold its Mangalore University campus for Rs 55 cr and leased back the same premises for a period of 30 years. The sales proceeds were invested to form Sri Gayatri Academy Pvt. Ltd. This move shows the management intent of being asset light and concentrate on its core activity of delivering coaching services.

8. Consistent Dividend Policy: MTEL has a good dividend policy and has been paying around 20-40% of the profits as dividend. With all the acquisition done from internal accrual, the company should see a very strong internal cash accrual in coming years.

Key Risks:

1. De-growth in Commerce section due to drop in pass ratio of CPT, IPCC and CA final: Commerce section of MTEL includes CA students. There was a drop in number of students enrolling for commerce in MTEL from 25000 in FY14 to 21000 students in FY15. This was mainly due to sharp drop in passing ratio for CPT(CA) and IPCC (CA) students which also led to reduction in enrollment for CA Final.

2. Competition from Unorganized Sector: There are many unorganized player in the coaching industry and MTEL continuously gets competition from such players, however with the introduction of innovative product Robomate & technology edge, MTEL is well positioned to differentiate itself.

Historical Stock Price

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having Registration No: INH000000875.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Mr Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts not his relatives have any position in the subject company.

2. Neither Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.