| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| MT Educare | 30Mar2013 | Rs. 80 | Rs. 160 - Rs. 200 | 7 / 10 | 30Mar2013 |

Our view - Business Fundamentals

MT Educare is the leading player in the steadily expanding coaching landscape in Mumbai and Maharashtra. From being a small time coaching provider for 9th and 10th grade, it has transformed itself into a broad based player in the coaching domain with presence in secondary school, science & commerce streams and competitive exams like IIT-JEE.

Along with the depth of coaching services, it has also increased its geographic presence by expanding in Maharashtra, Gujarat Punjab and Karnataka through a combination of innovative coaching models and inorganic acquisitions.

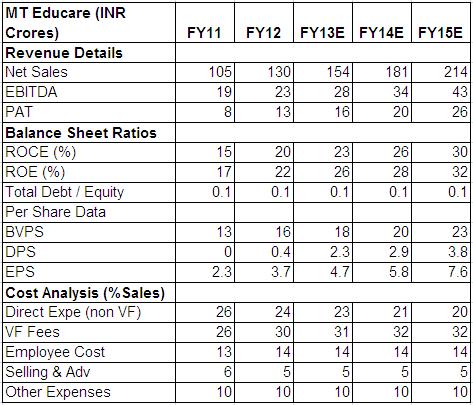

Management strategy has opened doors to multiple growth opportunities in a market that is relatively recession proof. The growth has been accompanied by meticulous corporatization, the first of its kind in an industry which is completely unorganized and teacher dependent. With standardization of delivery processes, training programs for instructors and smart use of technology, MT Educare has successfully grown from 8-10 branches in early 2000 to over 200+ in FY13 with relatively low capital investment. The low utilization levels in its recently opened branches at around 50%-60% leave strong room for operating leverage. Last but not the least, MT Educare has a strong balance sheet with zero debt, high cash levels and decent ROEs that allow liberal dividend payouts.

Our view - Stock Price, Returns Potential and Investment Strategy

Post its IPO at Rs80 in March 2012, the share price made a high of Rs142 in December 2012. The rise in price was mainly due to huge speculative activity on back of rumors about acquisition of Mumbai based JK Shah Classes. However the acquisition did not work out and the price has traced back to Rs100. We believe there is a very good comfort on valuations between Rs65 to Rs85 as the stock trades at P/E ratio of 15x FY14 with a dividend yield of 3.5%. Burning cash through expensive acquisitions and end of lock-in period for shares held by Helix (private equity player) and other anchor investors are immediate concerns for the stock. The stock should be bought in a staggered manner and should not exceed 7% of your portfolio.

A) Introduction

Company Background

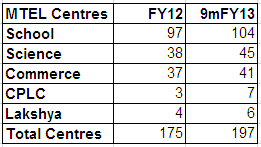

MT Educare Ltd is a coaching services provider for students from secondary school to graduation. It provides various coaching services to students and categorizes them into three main verticals – 1) School Section, where it provides coaching for 9th and 10th standard to students in Maharashtra & Gujarat, 2) Science Section, under which coaching is provided to the first year (11th) and second year (12th) students in Science who are mainly applying for Engineering and Medical CETs conducted by Maharashtra and Karnataka, and 3) Commerce Section, which includes coaching for various subjects of Commerce graduation and CA exams. It has a network of 200+ coaching centers* across 110 locations* in India.

*Each 'Location' can have more than one centre. For eg: Location Dadar (Mumbai) has 3 centres -Science, Commerce & School.

Management

Mahesh R. Shetty is the Chairman & Managing Director - Executive and Promoter of MT Educare Limited. He holds a bachelor’s degree in Science from the University of Mumbai. He started the business of providing coaching services to students in School Section in 1988 under the brand of “Mahesh Tutorials”.

Chandresh Fooria is the business head of the Science Section of MT Educare. He holds a Bachelor degree in Engineering (instrumentation) from Swami Vivekananda College of Engineering, Mumbai. He joined Mahesh Tutorials Science section as a visiting faculty in 1993 and became a partner in 1999.

Anish Thakkar is the business head of the Commerce Section of MT Educare. He is a member of the ICAI. He joined Mahesh Tutorials-Commerce section in 2003.

Shareholding Pattern

Helix private equity held ~29% before the IPO in March 2012. Currently Helix holds around ~5% and is expected to sell once its lock-in is over in 2013. In addition, a couple of years before IPO, 19% of the shares were given to HNI investors and their lock-in period will also end.

B) About business

Strong presence in a fragmented but a thriving industry The education system in India comprises of formal, vocation anal informal education. Formal education is heavily regulated by the Government’s Ministry of Human Resource Development (MHRD), while Informal education is unregulated. Although the Government has increased its outlay on Education over past decades, there is a clear shortage of quality institutions where quality of teaching is maintained. Considering this in light of importance given to examination scores in the Indian education system and competition to get admission into a limited number of premium institutes, there is a strong demand for good coaching institutes for competitive examinations and for sub sectors of formal education, pre-schools and vocational training. Currently, the coaching industry is highly fragmented and un-organized with only a few large players in specific states. Success in this industry depends on factors like ability to move away from teacher dependency by training new teachers and by scaling in new geographies.

Expansion across coaching spectrum to ensure multiple growth opportunities

MT Educare is one of the leading coaching service providers in Maharashtra, with primary operations in Mumbai and other centers in rest of Maharashtra. In the last 2 years, the company has started establishing its footprint in Karnataka, Tamil Nadu and Gujarat. Over the last 3 years, the company has grown very well with its sales rising from Rs73 cr in FY09 to Rs131 cr in FY12 translating into a CAGR of 22%. However, in the same period the profits have rose much faster at 72% CAGR from Rs2.6 cr to Rs13.2 cr. The company has also acquired 51% stake in Lakshya Forum, a leading IIT coaching from Punjab in FY13.

Source: Porspero Tree research

School Section: With a strong presence in Mumbai and rest of Maharashtra, School section contributes nearly 46% to revenues for MT Educare. Coaching is mainly provided for students of SSC and CBSE state board examinations. The company normally markets the 9th and 10th standard combo service to the students which helps the company to collect fees much in advance and improve its utilization.

Science section: With 45 / 200 branches devoted for Science coaching, this section contributes 26% of total revenues. MT provides coaching for 11th & 12th standard and prepares students for coaching. The focus here is on the training of Engineering CETs and Medical CETs. Within Karnataka, the company establishes tie-ups with existing colleges and provides coaching to their students for Engineering CETs. The company has already tied-up with 4 colleges across Karnataka and has around 1500 students in this model. Additionally 5 new colleges are expected to come under their belt in the next academic year.Source: Porspero Tree research

Commerce section: 19% of the total revenues come from this section. 100 / 200+ branches provide Commerce related coaching (B.Com, CA, etc). Apart from this, MT Educare has a tie-up with Bunts Sangha College, Mumbai to provide coaching to B. Com students along with UVA courses, CA-exams or MBA Test Prep. MT Educare has plans to increase the reach of Commerce offering for junior college students in Mumbai by rolling out batches at 20 new / existing centers in Mumbai.

Lakshya IIT Institute: MT Educare Limited bought 51 % stake in Lakshya Forum; an IIT, Engineering and Medical Entrance teaching institute, in 3rd quarter of 2012. This acquisition was done at 7x its FY12 earnings. The full effect of consolidation will start showing up from the last quarter of FY14. Lakshya has 4 centers in Punjab at Patiala, Bathinda, Chandigarh and Panchkula with revenue of around ~12 crores and profit of ~1.2 crores. With Lakshya’s expertise in the new advanced IIT exam pattern, MT’s Science section has started offering the same course in Maharashtra. In Mumbai, the company has already received enrollment of 100 students and this can increase drastically going forward.

CPLPL: MT Educare holds 51% shareholding in Chitale’s Personalised Learning Private Limited (CPLPL) which is engaged in the business of providing coaching services for CAT, GMAT and other entrance examinations for MBA colleges. The institute operates 5 centers in Mumbai. This contributes around 3-4% of the total revenue of MT Educare.

Karnataka Model: The company has rented its property at Mangalore to an Education Trust which runs a Pre-University College having a capacity of 3000 students. The capex invested for this college was around Rs31 crores and the company earns revenue of Rs60 Lacs per year as rent. Additionally, MT Educare has tied up with it for providing coaching services to engineering aspirants in that college. This PU college tie-up model has huge possibility of growth with comparatively lower costs in the form of faculty and marketing related expenses. MT Educare ties up with colleges that do not have a healthy student count admitted to their colleges. As a part of the offering, MT provides CET related coaching to the students of that college. The students get a combo-package of Regular Course (11th & 12th) and CET coaching, college gets more students and MT gets coaching fees.

Asset light model allows easy branch network expansion

Unlike the school & college model which is asset heavy, coaching class is an asset light business. The space for most of MT's coaching centers is rented and the only fixed cost incurred is towards furniture and technology equipments. The study material, the course content and faculty training are managed centrally and do not add significantly to costs. This helps MT in expanding its classroom network without incurring significant costs.

A testimony to the asset light model is the strong expansion from mere 20 centers in FY00 to 200+ centers as on FY13 without any meaningful debt. It operates 200+ coaching centers across 121 locations with 10 centers being operated on a franchisee model. Such a model will keep the company debt free and result in enhanced return ratios.

Faculty training & content delivery – the backbone of successful expansion

Teacher’s Factory: Retention, teacher career path, contract teachers (visiting faculty fees) MT Educare recruits faculty members through campus recruitment from selected colleges and from among ex-students who wish to associate with them. Faculty members are associated on contractual arrangements for a fixed term. Typically, the term of agreement is 3 years which may be renewed as mutually agreed. The faculty members are paid contractual fees calculated on the number of lectures as per the agreement and on an hourly basis for any extra classes undertaken. The management is extremely confident about getting the right teachers staff and boasts about an extremely low attrition rate. In addition to this, the content is delivered with the help of technology which makes it interesting for the students to learn and remember well. Special focus on preparing audio-visual presentations and student course material is taken, making MT's material the best in the industry.

Operating leverage to ensure improving margins

MT Educare has opened around 70 of its 200+ coaching centers over the last 3 years. Some of the new centers have been opened outside Mumbai, which has traditionally been its stronghold and would gain popularity among students only with time. There are coaching centers which currently offer only Science or only Commerce coaching. There is a huge opportunity to grow revenues without incurring major costs from these newly opened centers. This could result in at least a 100bps margin improvement over the next two years.

Competition intense, but robust model to ensure market share gains

Coaching industry is dominated with multiple small players and is usually a teacher driven business. Very few coaching institutes have been able to create a model that is independent of the teacher's reputation. Few of the large and successful players are listed below.

Source: Prospero Tree research

In the Commerce Section, specifically for Chartered Accountancy coaching services, main competitors are JK Shah Classes in Maharashtra, Gurukripa and Prime Academy in Chennai.

MT Educare with its centralized planning approach, strong balance sheet and careful expansion strategy has helped it in diversifying beyond its traditional business of 9th and 10th grade coaching, a feat which most other organized players have been unable to replicate. We believe MT Educare is well poised to take on the competition and grow its market share.

C) Investments arguments

Positive arguments:

1. Capex light model ensures scalability: MT Educare’s class room model ensures that it can grow its coaching center network without incurring huge capital outlay. A typical coaching center is taken on rent and only fixed costs that have to be incurred are furniture and technology costs. The Company has already planned to add 20 locations over the next 2 years, of which 8 locations have already been identified and 12 are in process. As a long term plan, MT plans to add around 5-10% branches per year across India.

2. Growing through innovative tie-ups: The PU college tie-up model that has been marketed in Karnataka has huge possibility of growth at little cost. MT Educare ties up with tier 3 colleges to provide CET related coaching to the students of that college. The students get a combo-package of Regular Course (11th & 12th) and CET coaching, college gets more students and MT gets coaching fees. It has already for 5 college tie-ups in FY13 with many other tie-ups lined up in FY14. MT Educare is also planning to monetize its vast course material by making it available for sale in digital formats.

3. Improving capacity utilization to boost margins: Given that MT Educare has opened a large number of its centers over the past 3 years, the overall occupancy is lower than around 60%. With time, we believe this can increase to 75%+. As majority of the costs per class is fixed, any improvement in the utilization directly finds its way to the profits, giving significant boost to margins. We expect profit margins to improve by at least 100 bps (1%) per year for next 3 years.

4. Using inorganic route to expand in other popular coaching segments: MT Educare has made two acquisitions in the past - 51% stake in 2011 in CPLPL which specializes in CAT, GMAT entrance exams and Lakshya Institute in 2012 which specializes in IIT- JEE, NEET entrance exams. Lakshya Institute serviced 2200+ students for FY 12-13 in its 4 branches in Punjab while 100 students have already enrolled in its recently launched center at Mumbai. MT Educare being a cash rich company will have opportunities to grow through inorganic route as well which wont come at a high price tag.

5. Negative working capital cycle, zero debt company: MT Educare collects advance fees at the beginning of the course-cycle, thereby having sufficient operational funds at its disposal to meet its expenses. As a result, the company has a negative working capital cycle. This coupled with capex light model has ensured that the company is completely debt-free.

Negative Arguments:

1. Lack of experience in non-Mumbai markets: MT Educare is heavily concentrated in Mumbai with ~75% of the total 207 centers in the city. Establishing a coaching center and building a reputation in a new city is a slow process and could result in longer than normal break-even time in locations other than Mumbai.

2. Past instances of spending cash in an unwise manner: The Company has invested Rs31cr to build a new college in Karnataka and has rented it to MT Educare Charitable Trust for a paltry annual yield of 2%. The ultimate beneficiaries of such an arrangement are the Private Trustees and Shareholders of MT Educare are bereft of fair returns on such a Project. The company also ventured in pre-school division but later sold its business (comprising of 6 company operated centers) to Tree House Education & Accessories Ltd in 3rd quarter of 2012-13.

3. Regulatory hurdles in expansion in Karnataka: MT Educare’s growth in the state of Karnataka is contingent upon the continuation of the present education structure which allows pre-university colleges. Any structural change in Karnataka state’s education system or any adverse regulatory action could hamper MT Educare’s tie-up model with pre-university colleges.

D) Financials

*Report Date may sometimes be different from Recommended Date as drafting of reports can take time.