| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| Patels Airtemp | 09Sep2014 | Rs. 125 - Rs. 130 | Rs. 200 | 7 / 10 | 09Sep2014 |

We suggest accumulation rather than buying in a aggressive manner

A) Company background:

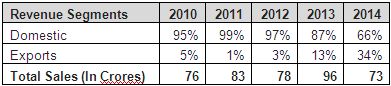

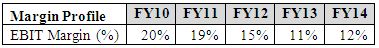

Established in 1973, Patels Airtemp (PAT) is a manufacturer of engineering products like Heat Exchangers, Pressure Vessels, Refrigeration and AC equipments. The Company’s sales have been static in the range of Rs. 70 crores to Rs. 90 crores in the last 5 years and its net profit margins have declined from 12% in FY10 to 6.6% in FY14. However, there are visible signs of improvement and we believe that Patels Airtemp is set for a better future based. Find below our investment arguments on the same.

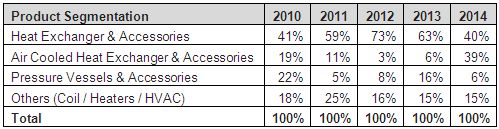

PAT’s Product Segment includes:

- Heat Exchangers: Heat Exchanger is equipment that transfers heat from one medium to another in the most efficient manner. Heat Exchangers are mainly used in the power plants, chemical plants, petrochemical plants & refineries and water treatment plants among others.

- Pressure Vessels: This is a closed container used to store gases or liquids at a certain pressure

- Refrigeration & AC Equipment: PAT takes turnkey projects for humidification, ventilation and air-conditioning of industrial units and commercial spaces like offices, malls, residential complexes, and so on.

B) Investment arguments:

1. Well positioned to benefit from the growing Heat Exchanger market: The global heat exchangers industry is expected to grow at 10% cagr due to:

- Growing domestic demand from chemical, petrochemical and power sector

- Replacement market demand from the Americas, Middle East and European market (useful life of Heat Exchanger is 20-30 years)

- Significant growth kicking from India and China led by industrial demand where captive power plants and chemical processes requires heat exchangers

- Increased thrust on energy efficiency where heat exchangers play a critical role.

India being a net importer of heat exchangers provides large opportunities for a player like Patels Airtemp to grow at higher than industry growth rate.

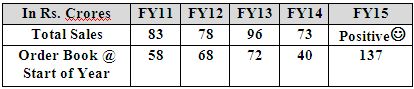

2. Strong order book position; marketing efforts enhance future visibility: Over the past 4 years, Patels Airtemp’s outstanding order book has never exceeded 80% of its annual sales. Starting FY15, its order book stands at Rs. 137 crores (this is almost 2 times its FY14 sales).This clearly portends a very healthy sales growth for FY15.

The recent traction in the order book is on back of strong orders received from Oil & Gas sector in India. Additional, the company is also tapping the exports market with full force to diversify its revenue base. In the last 3 years, export revenues have increased from Rs. 2.5 crores in FY12 to Rs. 25 crores in FY14.

The company is now focused towards building a professional marketing team for the exports market. It has also secured various certifications like ASME "U" / "U2" / "S" Stamp Authorization that will help them to get export orders from USA, Canada & Europe. The above factors give tremendous visibility in terms of order book and revenue growth for PAT.

3. Experienced management, diversified client portfolio: PAT is promoted by N. G. Patel and his two sons, all of whom are very well qualified with mechanical engineering and MBA degrees. Together, the father-son trio has a total experience of 70 years in this field. Some other members of the board are taking active role in strategic decision and capital allocation.

Based on our research, management and vendor interaction, we are convinced that the promoters are quite conservative as seen by the cash flow management, judicious capex and managing the macro downturn of 2009-2014 very well. The company’s client list includes marquee names like Reliance Industries, ONGC, HPCL, Chennai Petro, Siemens, and Alfa Laval, among others.

4. Margin improvement on cards:

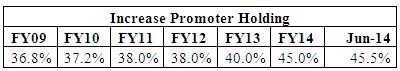

5.Stake enhancement by promoters an encouraging sign: The promoters of Nirma (Lalbhai Patel) were holding nearly 30% shares in this company since the IPO time. However, they liquidated their holding in Patels Airtemp, due to which large portion of shares was seen as public shareholding. As Patels Airtemp earned more and the price was cheap, the promoters acquired shares from the open market. From the low of 30% holding the promoters now hold around 45.5% holding. Their last buying transaction was in the month of August 2014 at the price of Rs. 87. We think that promoters might be interested to reach to at least 51% if the price stabilizes. Being a small cap company with low market cap, the promoter buying gives tremendous comfort.

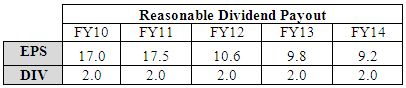

6.Clean Balance Sheet & attractive dividend payout:Apart from the small working capital debt, it is virtually a debt free company. Patels Airtemp has a history of rewarding shareholders through good dividend, which is set to increase with the growth kicking in.

7. Attractive valuations: At Rs. 130, Patels Airtemp is quoting at a market cap of Rs. 65 crores. This means a multiple of 14x its FY14 earnings. However, we think that Patels Airtemp profits should double in FY15 by strong order book (3 times of last year) and margin improvement. This indicates that the stock is available at 7 times price-to-earnings ratio. Based on improving domestic demand, thrust on export sales, visibility of order book, clean balance sheet and trustworthy promoters, there is a strong case for investment in this stock. We recommend to Buy Patels Airtemp at the CMP of Rs. 130 with a target of Rs. 180- Rs. 200.

C) Key risks:

- Fixed price contracts; raw material price risk

- Delay in order execution can lead to penalties

- Increased competitive intensity

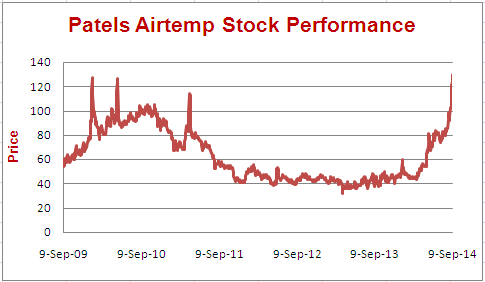

D) Stock Performance:

*Report Date may sometimes be different from Recommended Date as drafting of reports can take time.

Read Our Disclaimer and please do your due diligence and / or consult your financial adviser before taking any action.