| Name | Patels Airtemp |

| Type of Report | Update |

| Report Date | 11Jun2015 |

| Price on Report Date | Rs. 125 |

| View | Buy |

| Indicative Target Price* | Rs. 200 |

We recommended Patels Airtemp at Rs. 125-130 in Sep 2014 and re-recommended at Rs. 164 in Nov 2014. We continue to remain bullish over a long term and would suggest investors to BUY at CMP of Rs 125. #Achievement of Target Price does not imply Sell. We will explicitly release a Report for that.

We met the management post the FY15 results of Patels Airtemp (PAT). Below are the result's highlights and some other important pointers:

1. Excellent Growth in FY15: PAT achieved Rs. 113 crores of revenues, a growth of 59% over FY14. However, the profit growth was lower at 32% due to increase in raw material costs and finance charges.

2. Order Book Going Strong: Patels Airtemp has an order book of Rs. 142 crores that should be executed over next 12-18 months period. Based on the current order book size, the FY16 revenue should see some growth over FY15. At the same time, the company is looking at participating in more PSU tenders and private companies' negotiations for getting more orders.

3. Actions by Management:

- Increasing Capacities: PAT has been slowly investing into important machinery that help them to de-bottleneck and significantly scale up the operations. Currently they have capacities to take orders worth Rs. 200-250 crores without any incremental capex.

- Expanding into Newer Geographies: PAT is focusing heavily on growth in export markets mainly in Middle East, US, Canada and Africa. To support these plans, it has registered itself with various Middle Eastern nations and is planning for tie-ups with various certified agents who have access to these regions. This is a long process and we believe that all of above will start yielding results in a year's time.

- N-Stamp Certification: The Company has been preparing for getting an N-Stamp certification which will enable itself to apply for Nuclear Power projects tenders. The company is quite confident in achieving the certification. If received, the company will be 4th company in India to receive such a certification. Though a little far, the nuclear opportunity can improve the growth prospects of the company in a very huge manner.

Valuation: At current market price of Rs. 125, PAT is available at a market cap of Rs. 63 crores with profitability of Rs. 6-7 crores indicating a 10 times trailing price to earnings multiple. Comparing this with the capital goods industry valuations, PAT is reasonably cheap.

The upside for PAT stems from the strong foundation being built by management focusing on:

- Canada Based Exports: Tie-up with a Canadian player; Supplied in last couples of years; Stability in crude prices should give future orders.

- Middle East and Africa Entry: Currently Zero Revenues; however, certifications in progress.

- Indian Private Sector Demand: Capex Cycle on standstill over last few years; expected to be revamped.

- Nuclear Plants: N-Stamp certification in progress; Huge opportunity in India yet to come

Key Risks:

- Fixed Priced Contracts: To protect the same, PAT books major raw material the moment an order has been finalized.

- Unpredictable margins: As the company is participating in the government tenders, estimating a common EBITDA margin is not possible.

- Late Delivery Charge: Due to the PSU business, the company has been consistently charged Late Delivery charges to the tune of 1.5-2% for last couple of years. A lot of times, the delays in execution are due to the government side; but even then the same are being paying to the company. The company has been showing the same as expense; however, as the negotiations for the same are being carried off, there is a chance that some of these charges may reverse.

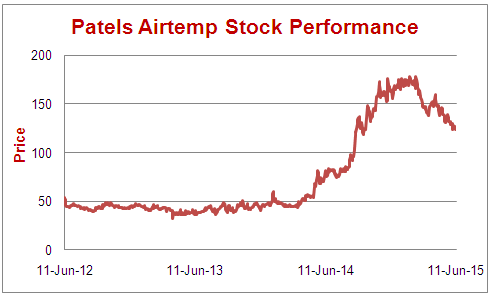

Historical Stock Performance

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under: