We recommended Patels Airtemp (PAT) at Rs. 125-130 on Sep2014. Post which the stock price made a peak of Rs. 185. On correction we re-recommended Patel Airtemp to be bought at Rs. 125 (reports below).

| Date | Patel Airtemp Past Reports |

| 09-Sep-14 | Patels Airtemp: Strong Orderbook Led Growth |

| 14-Nov-14 | Patels Airtemp: Second Half to be better than First Half |

| 11-Jun-15 | Patels Airtemp - Creating Stronger Foundation |

| 18-Aug-15 | Patels Airtemp - Best Ever June Qtr Sales |

Though, in terms of price performance, the stock has not moved up significantly, however, Patels Airtemp business performance has continuously improved and seems to be now set for moving into higher trajectory.

Here is a short summary on the same.

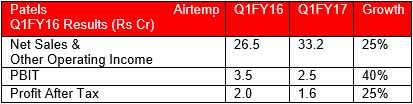

1. Good June Results Q1FY17: Although June quarter for the capital good industry is usually weaker, PAT clocked a healthy sales growth of 25% from Rs. 26.5 cr in Q1FY16 to Rs. 33.2 cr in Q1FY17. Based on the feedback, the company started this year with an extremely healthy and highest ever order book.

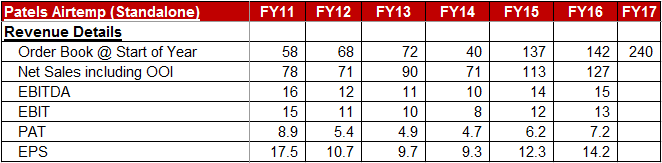

2. Turning from a small to mid-sized player: Before a couple of years, Patels Airtemp sales stagnated to 40-70 crores range. Beginning FY15, Patels Airtemp has been able to expand its skillset, capacity and marketing initiatives leading to 2 continuous years of revenues in the range of Rs 130-140 crores. Currently the company has an order book of Rs. 240 crores which is almost double of highest ever sales of any previous year.

3. Strong Initiatives taken to maintain growth: Patels Airtemp is working rigorously to get into newer markets with professional team and agent network for Marketing in India and international markets. Further, it is working very closely with the ASME authorities for last 3 years to secure N-stamp certification. Once awarded, it will open doors for Patels Airtemp to participate into various opportunities which have a requirement for N-stamp certification. The company is expected to achieve the certificate for the same in this year (FY17). To support these activities, Patels Airtemp has already ramped up its capacity to be able to support execution of Rs. 200-250 crores per year.

Valuation: At current market price of Rs. 135-140, PAT is trading at a market cap of Rs. 68 crores and profit of Rs. 7.2 crores which translates in to less than 9.5 times trailing multiple. Considering attractively absolute valuation and attractiveness against other capital goods players, we continue to remain bullish over a long term and would suggest a HOLD on the stock.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.