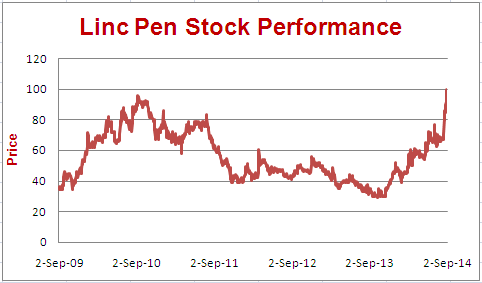

ProsperoTree.com recommended Linc Pens at Rs. 95-100 on 02-Sep-2014. Currently Linc is trading at Rs. 170 giving 73% returns within a year.

Recently, Linc Pens announced its Q1FY16 quarterly results. In the current quarter, sales grew by 9% YoY to Rs. 77.5 cr and its profits grew by 14% to Rs. 3.7 crores. We recommend a Hold on the stock at current levels of Rs. 170.

Below is the update on Linc Pens:

1. Nearly Double Digit Growth After 8 Quarters: It was after 8 quarters that Linc saw decent revenue growth. Growth was subdued in the past mainly because the phasing out certain low priced products and exports being affected due to political problems in certain countries. Q1FY16 sales growth of 9% YoY was driven by 18% YoY growth in pens priced Rs. 10+ and 12% exports sales growth. The strategy of the company to focus on higher margin pens seems to be paying off.

2. Expanding Geographical Presence: Being Kolkata based, Linc has a better presence in Eastern and Northern India. However, the recent advertisement initiatives and widening of distribution network has helped the company achieve 25% YoY sales growth in Southern region of India. The growth rate in new territories will likely remain higher.

3.Improvement in Margins Despite Higher Advertisement Cost: The operating profit margins (EBITDA) stood at 8.1% as against 8% in Q1FY15. This is in spite of much higher advertisement cost that increased from Rs. 1.4 cr in Q1FY15 to Rs. 2.9 cr in Q1FY16.

4. Margin Improvement to Continue: There is further scope to increase margins in Linc due to:

- Cost saving from increased in-house assembling: Linc enhanced its in-house assembling capacity by 50 lakhs units per month leading to a total capacity of around 1.4 crores units per month. Due to this, the production costs are expected to come down.

- Reduced crude price: Reduced crude prices should eventually translate into further savings from raw material costs.

- Moving up the value chain: The focus of the company towards selling pens prices Rs. 10 and above will further help the company to improve margins. After super success of Linc Twin Pen, it is going to launch Linc Touch Pen which is priced at Rs. 20 and has pen on one side and a stylus on other side.

Valuations: We maintain a Buy on Linc Pens at CMP of Rs. 167 and a market cap of Rs. 247 cr. With the company now debt free, we think that Linc’s strategy to focus on high value pens, brand strengthening exercise along with improvement in distribution network and exports thrust will eventually help the company to achieve much better results in times to come.

Here is the list of reports written before on Linc Pens for your reference:

1. Linc: Set to Write a New Chapter

2. LINC: Marketing Strategy

3. LINC Pen: Channels Checks; Maintain View

4. Linc: Beneficiary of Crude Price Fall

5. Linc: Margin Showing Strength

6. Linc Pen: Moving Up The Value Chain

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.