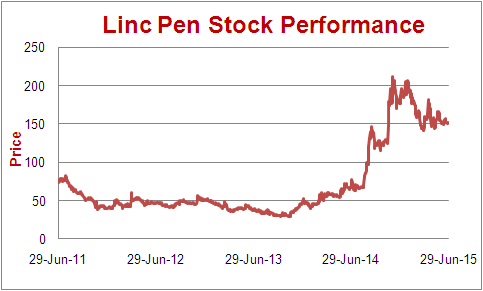

ProsperoTree.com recommended Linc Pen at Rs. 95-100 in our first report dated 02-Sep-2014 - Linc: Set to Write a New Chapter. We further updated on the same for which the reports can be accessed below:

1. LINC: Marketing Strategy

2. LINC Pen: Channels Checks; Maintain View

3. Linc: Beneficiary of Crude Price Fall

4. Linc: Margin Showing Strength

Recently, LINC Pen announced its FY15 Results. The sales in FY15 grew by a meager 1% to Rs. 318 crores whereas its profits in FY15 increased by 24% to Rs. 14.3 crores. We maintain a BUY on the stock at current levels of Rs. 150.

Below is the Update on Linc Pen:

1. Strategy of Moving to High Margin Pens Paying Off: The strategy of withdrawing low margin pens (Rs. 5 and below) and moving to higher margin pens is paying off. Due to this, the sales growth has been flattish; however, the profit growth is 24% for FY15.

2. Margins Continuously Improving: Due to the focus on sales mix change and savings from raw material, Linc has been able to improve its margins. The EBITDA margins have improved from 4% in FY12 to 8% in FY15. This picture could be even better if we don’t consider the recent advertising campaign of Linc Twin Pen during the cricket world cup. For instance, the advertisement spends for Linc Pen in FY15 is Rs. 6.6 crores as against Rs. 3.1 crores in FY14. The benefits of this advertising campaign should accrue in the coming years.

3. Strong Brand Building Exercise: With improving balance sheet, the company has now decided to focus even more on building its brands and support the same by innovative products pipeline. In the recent past, Linc has advertised in a very effective manner in the Cricket World Cup and IPL. We think that the ability of Linc to generate high free cash flows will easily support the brand building exercise. The advertisement spends for Linc Pen in FY15 were at Rs. 6.6 crores as against Rs. 3.1 crores in FY14.

4. Reducing Debt; Debt Free Status Soon: Linc has been continuously paying all its debt and now it does not have any long term liabilities. The short term debt stands at Rs. 18 crores which should be paid off within next 12 months and Linc should be able to achieve a Debt Free status. As a result, its interest cost has also reduced substantially from Rs. 4 crores per year to Rs. 1.5 crores currently.

5. Exports Growth should Resume: The FY15 exports stood at Rs. 87 crores, de-grew by 4% due to turmoil in political condition of some of the countries and major upheaval in currency prices. It was the first time in 15 years that Linc witnessed a de-growth in exports sales. However, the management has taken corrective action and is looking to have decent growth in exports sales here on.

Valuations

At CMP of Rs. 150, LINC is trading at a market cap of Rs. 220 cr with a profitability of Rs. 14 cr in FY15. The company has an overall strategy to further improve profitability through:

- Better sales mix

- Exports sales growth

- Improvement in productivity

- Increased in-house production

- Improving distribution in Western India

We first recommended Linc at Rs. 95-99. Report can be accessed here: Linc: Set to Write a New Chapter

Key Risks

- Exports saw degrowth for the first time in 15 years. Further degrowth in exports pose a risk to the company. However, management is quite assertive about its corrective action on this front.

- Sudden increase in Raw Material Cost

Historical Stock Price