ProsperoTree.com first recommended LINC Pens at Rs. 98, the report for which can be accessed here (LINC Pens research report). Since then, LINC Pens has performed well and delivered 51% in a span of two months.

Recently, LINC Pens announced its quarterly results, which in our opinion is encouraging. Our conviction in the turnaround story gets stronger and helps us to maintain BUY on the stock at current levels of Rs. 148.

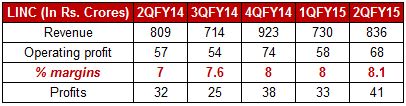

A. LINC Pens Q2FY15 results summary

In-line with its strategy of phasing out low-value products and introducing high value products, LINC pens reported a mere 3% YoY growth in revenue for 2QFY15. EBITDA margins however improved 100bps on YoY basis and is largely responsible for strong earnings growth. The balance sheet too has improved with debt declining from Rs. 47crores in 4QFY14 to Rs. 39crores in 2QFY15.

#Historically March Quarter is the best quarter as the demand from School Children increased due to exams.

B. Early signs of success at moving up the value chain

In contrast to its earlier strategy of introducing lower priced products to gain market share, LINC Pens has started phasing out slow moving, low priced products in favour of high value products with higher margins. The company introduced 2 new products and re-launched 1 product in the current quarter.

The above strategy has been consistently implemented and can be seen from past five quarters:

- Sale of products priced above Rs. 10 grew by 35% and 44% for 1QFY15 and 2QFY15 respectively over previous year.

- Operating margins have improved 110bps over the past five quarters indicating better realizations and operating efficiency.

The management is consciously introducing higher value products, this share of which is just 10%. As this segment gains mass, we will witness a revival in revenue growth as well as improvement in margins. We note that operating margins of Cello, the largest pen maker, is at 24% and leaves a lot of room for LINC Pens to improve its margin profile.

C. Valuations still attractive, long way to go

We believe that the Company Management’s effort to improve margins through realigning the writing instruments portfolio, reducing the proportion of outsourced products, factory efficiencies will ensure steady improvement over years to come. The current decline in crude oil prices only improves the possibility of further margin improvement.

The stock currently trades at 15x FY14 earnings. Considering the low levels of balance sheet debt, improving margins and possibility of sharp revival in revenue, we believe that LINC is set for re-rating. We recommend existing investors to HOLD the stock while new investors can look to BUY at current price of Rs. 145-150.