| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| LINC Pens | 02Sep2014 | Rs. 95 - Rs. 99 | Rs. 180 - Rs. 200 | 7 / 10 | 02Sep2014 |

A) Company background:

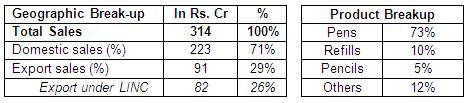

Established in Kolkata in 1996, LINC Pens is the 3rd largest writing instrument company in India after Cello Pens and Reynolds. It is engaged in the manufacturing and sale of pens, refills, pencils and all kinds of student stationery.

Its products are also exported to more than 45 countries across the globe under the LINC brand.

B) Investments arguments:

1. Steady long term growth for LINC: With increasing literacy rates (74%), increased thrust on education spending by government and large student population, the writing instruments industry is set to grow at a very healthy rate. LINC being one of the biggest brands in India is set to benefit out of this trend. In addition, LINC has established export bases in nations with similar demographics to ensure export oriented growth. We believe LINC has a strong chance to grow at double digits for next 3-4 years.

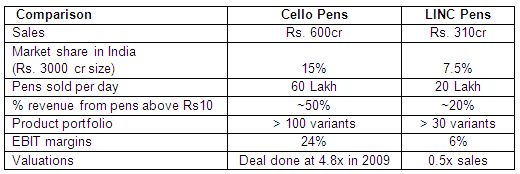

The Indian writing instruments market is valued at Rs. 3,000 cr

2. Strong product portfolio catering across user categories: LINC has a strong product basket consisting of more than 25 varieties of ball pens, 15 varieties of gel pens and stationary across various price points and user categories. It introduces 5 to 10 new products every year. LINC also markets high-end pens under its own brand -Cruiser, Mitsubishi Uniball and a German brand Lamy.

3. Shifting focus to higher margin pens: Pens in the less than Rs. 10 segment contributed nearly 90% of sales volumes prior to 2008 which had relatively lower margin. The company changed track in 2008 and invested Rs. 50 cr in branding & advertising over 2009-2013. To put in perspective, LINC profits in the same period were just Rs. 35 crores, far lower than its advertisement spends. Due to the aggressive branding, LINC was able to improve the share of high valued products (more than Rs10 per piece) to 25% in 2013 from 10% in 2008. We believe that the benefits of the LINC brand have started to accrue and will accelerate over next five years leading to significant increase in margins. At the same time, LINC has also increased the proportion of in-house manufacturing leading to further efficiencies creeping in.

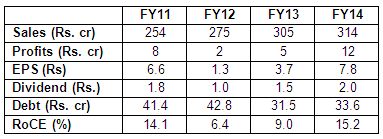

4. Early signs of margin improvement: Based on the strategy of moving to higher priced pens, LINC completely stopped selling pens below Rs. 5 per piece. Due to this. the overall sales grew by 3% in FY14, however, the margin improvement led to a strong profit growth of 112%.

5. Introduction of Luxury Pen -Cruiser: In 2012, LINC introduced Luxury pens under its own brand – Cruiser that are priced between Rs. 1,000 to Rs. 11,000 per piece. The company is focused on growing this brand that can lead to good growth in margins for the company.

6. Investment by Mitsibushi lends credibility and enlarges scope of business: The Japan based Mitsibushi Pencil Company (Uniball) purchased a 13.5% stake in LINC at Rs. 100 per share. This partnership will help LINC increase the proportion of high value products, especially under the Uniball brand (Rs. 30 to Rs. 225). LINC also markets & distributes products of the Germany based C. Joseph Lamy (Rs. 550 onwards).

7. Strong balance sheet, attractive valuations: LINC’s debt-to-equity stands at 0.4%, working capital requirements have been steady at 25% of sales and asset turnovers are high at 10x. The RoCEs on improved FY14 performance stands at 15% and EPS for FY14 was Rs. 8. If LINC is successful in positioning itself higher in the pen value chain, profitability could well be on a multi-year uptrend. Valuations at 12x FY14 earnings offer strong upside.

8. Comparative Perspective -LINC vs CELLO: In 2009, when Cello had sales of Rs. 410 crore, BIC of France bought 40% stake in Cello valuing it at Rs. 1975 crores. BIC later increased its stake to 75% and has further option to increase upto 90%. The above deal meant that Cello was valued at 4.8x sales.

In 2012, when Mitsubishi bought 13.5% stake in LINC, It paid more than double the then market price of Rs. 40-45. This premium will be much higher in case Mitsubishi decided to increase its stake from minority stake to a controlling stake.

C) Key risks:

a. Unable to increase market share due to other 4-5 major players in India

b. Major increase in the raw material costs

D) Financials:

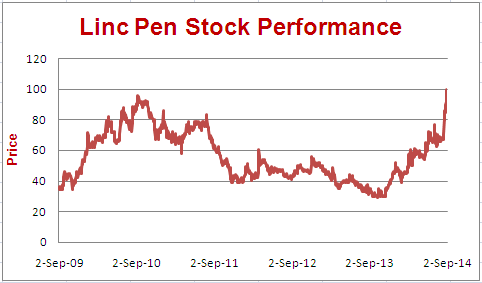

E) Stock Performance:

*Report Date may sometimes be different from Recommended Date.